Cars

Find out how to finance a car with Creditas and leave with the keys to your car in hand!

Find out how to finance a car with Creditas, understand the steps, discover the benefits, who can apply, and how to get lower rates with a guarantee.

Advertisement

Understand everything about the financing process and get your car!

Financing a car with Creditas is a modern alternative for those seeking lower interest rates, less bureaucracy, and a fully digital and accessible process.

Unlike traditional banks, Creditas allows you to use your vehicle as collateral, which helps significantly reduce the amount of installments.

Furthermore, the hiring process is simple, with clear steps, quick analysis, and personalized service from start to finish, all directly on your cell phone or computer.

Want to understand how financing works? Find out who can apply, what the benefits are, and why Creditas has stood out so much.

What is Creditas?

Creditas is a fintech that has been gaining traction among Brazilians seeking smart alternatives for services like car financing.

It operates by offering secured credit. This means you can use your own asset, such as a vehicle or property, to get better terms.

When choosing to finance a car with Creditas, customers enjoy fairer rates, flexible terms, and a fully digital process from start to finish.

With a focus on transparency, agility, and personalized service, Creditas has become a benchmark in simple, secure financial solutions designed to make your life easier.

Why financing a car through Creditas may be the best choice

When it comes to car financing, it's common to think of high interest rates and a lot of bureaucracy. But with Creditas, this experience completely changes for the better.

The company offers a modern, secure solution designed for those looking to save money. With fewer complications and more benefits, the customer benefits in every way.

Real economy: lower interest rates than traditional banks.

One of Creditas' biggest differentiators is its interest rates, which are significantly lower than those offered by traditional banks.

This happens because, when financing a car with Creditas with a vehicle guarantee, the risk is lower and, therefore, the customer pays less interest.

In practice, you can save a lot over the course of your contract. Even with affordable installments, the final cost is usually much fairer and more transparent.

This difference in rates can translate into thousands of dollars in savings. It's a perfect solution for those seeking a balance between security and real savings.

Payment flexibility that fits your budget.

Another point that stands out is the flexibility to choose the installment amount and term that best fits your monthly budget.

Creditas understands that each client's circumstances are different. Therefore, it offers personalized options that respect your income and current financial commitments.

You don't have to strain your budget to own your car. Financing is designed to fit your budget without causing stress at the end of the month.

This flexibility ensures greater peace of mind during your financial journey. After all, realizing a dream can't turn into a long-term problem, right?

Fast approval and 100% online.

With Creditas, you don't need to leave your home to get credit. The entire application and analysis process is digital and secure.

When you decide to finance a car with Creditas, you submit the documents, fill out the information, and follow each step directly from your cell phone or computer.

The analysis is quick and straightforward. In no time, you'll know if you've been approved and what the financing conditions are.

This agility makes life easier for those in urgent situations who value time. No more lines, paperwork, or days of waiting for a response.

How car financing works at Creditas.

Car financing with Creditas is simple, fast, and completely digital. The process is divided into easy steps that anyone can easily follow.

From the simulation to the release of the price, everything is handled clearly and quickly. This way, you can acquire your car safely and without bureaucracy.

Simulate your financing for free.

The first step is to simulate financing directly on the Creditas website. Enter your details and receive a personalized, no-obligation preview.

Anyone looking to finance a car with Creditas can start with this simulation, which is free, quick, and shows the real conditions before moving forward.

Submit your documents and go through the credit check.

After the simulation, you submit your documents online. It's all digital, convenient, and secure, with no need to wait in lines or deal with paperwork.

The credit analysis is based on the information submitted. Creditas then evaluates your profile and determines the best terms for your contract.

Signing of the contract and release of the amount.

If approved, you'll receive the contract for electronic signature. Everything is done securely and from the comfort of your home, using only your phone or computer.

After signing, Creditas releases the financing quickly. This process is transparent, and you can track every step of the way through the platform.

Transfer of the vehicle to your name.

Once the funds are released, the car is purchased and transferred into your name. Creditas ensures that everything is done safely and legally.

Anyone who chooses to finance a car with Creditas can count on support throughout the entire process, including the final part, until the car is in their hands.

Who can take out a loan with Creditas?

Creditas car financing is accessible to a wide range of profiles. However, to be approved, it's important to meet some basic and fundamental criteria.

Even with a simplified process, Creditas prioritizes security. Therefore, it carefully analyzes each request before releasing the loan to the customer.

Basic requirements for financing approval.

To finance a car with Creditas, you must be over 18 years old, have proven income, and a good financial history in recent months.

The company also requires updated and valid documents, such as ID, CPF, proof of residence and proof of income compatible with the amount requested.

If the vehicle is used as collateral, it must be in good condition, with regularized documentation and within the standard required by Creditas.

Additionally, it's essential to have a healthy financial profile. This increases your chances of approval and ensures better installment terms in the final contract.

Can I finance even if I have a bad credit rating?

Unfortunately, those with a negative credit rating may find it more difficult to get credit approved, even with a good previous score.

Creditas analyzes each client's history. In some cases, it may be necessary to clear the creditor's name before applying for new secured financing.

However, if your name was negatively listed by mistake, it's worth correcting the issue and trying again with the correct documentation in hand.

Having a clean record is one of the main factors for approval. Therefore, it's recommended that you resolve these issues before submitting your online application.

Financing for self-employed individuals and micro-entrepreneurs: is it possible?

Self-employed individuals and MEIs can also apply for financing, as long as they can prove their income through bank statements or tax returns.

Creditas understands that many Brazilians are self-employed. Therefore, it created a more flexible analysis for those working outside the CLT regime.

If you're self-employed, keep your bank records organized. This helps demonstrate your ability to pay and increases your chances of approval.

With a clear and well-presented profile, it's entirely possible to acquire your car through Creditas, even without a formal contract.

Can I finance a used car? Understand the rules.

Yes, it's possible to finance a used car with Creditas. However, it must meet certain specific criteria defined by the company.

The vehicle must be up to ten years old, in good condition and with up-to-date documentation to be accepted as collateral for financing.

Anyone wishing to finance a car with Creditas must present a vehicle inspection report and an updated vehicle registration certificate (CRLV) to prove the vehicle's legality and safety.

By following these requirements, the process runs smoothly and you can secure your used car with greater savings, safety, and convenience.

Exclusive advantages of financing with vehicle collateral.

Car financing with collateral is a smart option for those who want to pay less interest and have more control over their monthly financial planning.

By using an asset as collateral, the company's risk is reduced. This translates into better terms and lower installment payments for you.

In addition to reduced rates, customers can also choose longer terms and higher amounts, leveraging the potential of their vehicle as a form of support.

Anyone who decides to finance a car with Creditas with a guarantee can also count on dedicated service and a faster, safer, and more advantageous process from start to finish.

Conclusion

Financing a car with Creditas can be the ideal option for those seeking convenience, savings, and conditions that truly make sense in their everyday lives.

With a secure, digital process and much fairer rates, Creditas stands out among the options available in the secured credit market.

Now that you know the benefits, it's easier to make a confident decision and take the next step toward getting your dream car out of the garage.

Did you like it? Want to compare and understand other options? Read the article below and learn all about renting a car simply and safely.

Best car rental companies in Brazil

Short summary of the recommended post

Trending Topics

Customer Service Course: Improve Your Skills and Delight Your Customers

Take the Customer Service Course and stand out in the market! Develop your communication, empathy and problem-solving skills.

Keep Reading

You Deserve Your New Vehicle: Learn How to Finance Cars in Mexico!

Want to finance your new vehicle without the headache? Then check out how to finance cars safely in Mexico!

Keep Reading

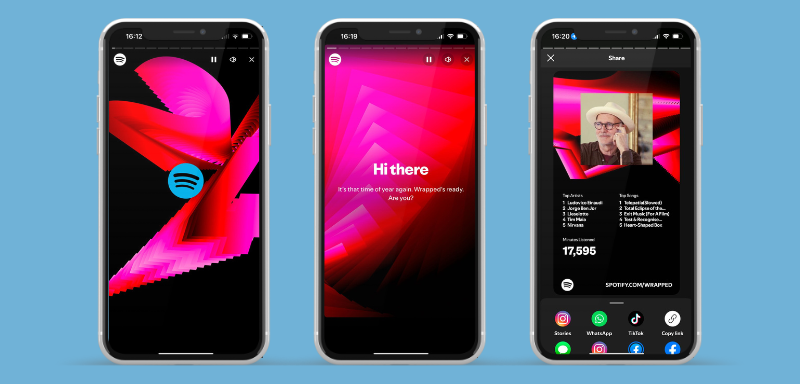

Spotify Wrapped: A Look Back at the Songs of 2024

Your 2024 musical journey is ready to be revealed! Explore your Spotify Retrospective and discover the hits that defined your year.

Keep ReadingYou may also like

SEBRAE Courses: Your journey to growth starts here!

Want to transform your business? Discover how SEBRAE courses can boost your entrepreneurial journey with the right training and real results.

Keep Reading

Artificial Intelligence Applications: Check out the best ones

Discover the Artificial Intelligence applications that are transforming the way you use technology.

Keep Reading

Learn How to Avoid Getting Frustrated on Dating Apps Right Now!

Learn how to avoid frustration and find the perfect match on dating apps right now!

Keep Reading